Once upon a time, Kumar Birla dreamt of making more millions from the retail sector. His huge investments in More have gone up in smoke.

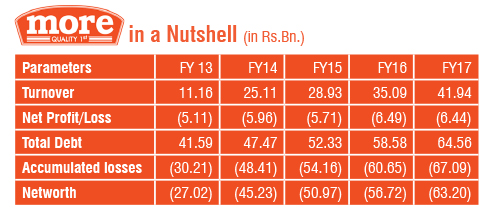

Although no official information about the deal size is available, market specialists estimate it at approximately Rs.42 billion. As a result, the Birlas will lose Rs.70 billion in the venture excluding writing off of Rs.10 billion of debt on borrowals from unlisted companies. Though several regulatory clearances have to be procured to make the deal complete, it will be one of the revolutionary developments in the retail segment.

Some more facts

More is the fourth-largest superstore group in India after Future Group, Reliance Retail and Avenue Supermart, which owns the D-Mart brand. It operates roughly 500 supermarkets and 20 hypermarkets.

In 2007 Kumar Birla planned to establish a chain of 1000 stores with a substantial investment. The South Indian supermarket chain Trinethra, Fabmall and Jubilant Retail’s Total Superstore were bought. Notable global advisors such as AT Kearney and Boston Consulting Group have been chartered to guide the business operations.

More gave less happiness to Birlas

Recently, MORE did achieve a break-even with focus on store rationalisation, shutting unviable stores, fine-tuning its store format strategy and better operating cost management. But severe competition from the Kirana or small neighbourhood retail stores, the Aditya Birla Retail Ltd (ABRL) failed to meet the benchmark standard of net margins in food and grocery retail.

Huge debts incurred primarily due to certain management choices, blocked the transformational journey of the entity. As a result, ABRL continued to suffer losses wherein competitors succeeded in making money.

Bad development schemes and worse selection of locations for hypermarkets added fuel to the fire of failure. Unlike its rivals, ABRL failed to focus on major cities of India.

Hope the More deal turns the decision of Samara a profitable one and helps the Birla group concentrate more on its lucrative businesses of rayons, cement, finance, telecom and metals. Hope Amazon which has already taken the position in the offline retail stage by joining hands with Kishore Biyani’s Future Group, will utilise this god-sent opportunity and enjoy its Dil Maange More journey.