Paying tribute to former chief minister C N Annadurai, Tamil Nadu’s present CM, M K Stalin rolled out the most awaited poll promise of Rs 1000 per month for women. With an outlay of Rs 7000 crore, this scheme is to benefit 1.06 crore women across the state. Like several schemes from the state that have set a precedence, this scheme too has an important feature, targeting beneficiary.

The base for Tamil Nadu’s growth has been the focus on social welfare along with development. The mid-day meals scheme set stage to an education revolution and has been emulated across the country. The state has reaped rich dividends through several such social investments. While this Kalaignar Magalir Urimai Thittam (KMUT) is one among them, the unique aspect of this scheme is the targeted

Women itself form a subset of the state’s population and among them, the scheme targets another sub section based on a list of criteria that ascertains their social position. The criteria were listed and then applications were received by the state. This transparent categorising itself helped the state create a boundary. While Tamil Nadu has benefited much from welfare schemes, the financial burden reflects in its budget and especially borrowings.

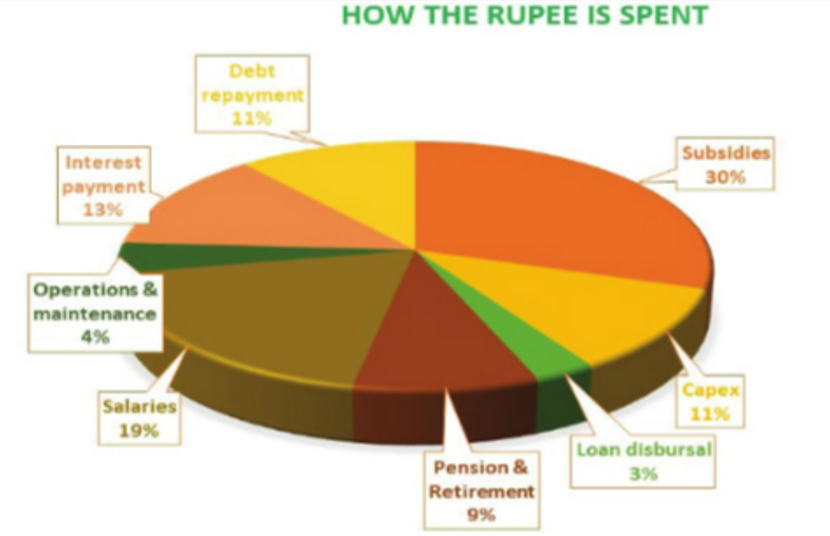

Less left in revenue for capex

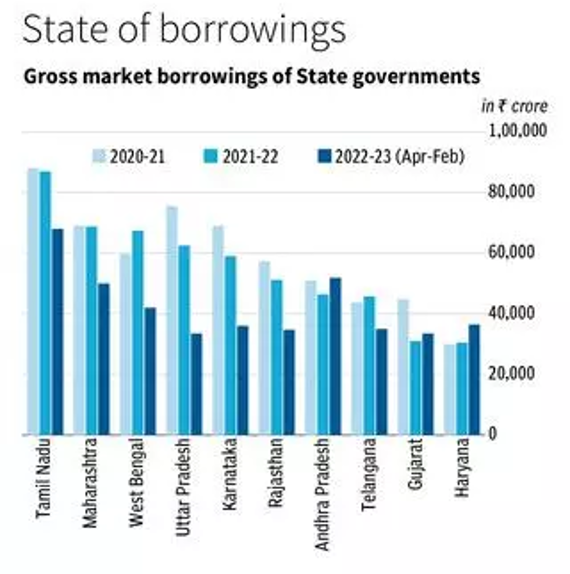

For third year in a row, the state was the highest market borrower in 2022-23. According to RBI data, Tamil Nadu borrows through State Development Loans and it stood at Rs 87,000 crore in FY23 and FY22 and Rs 87,977 crore in FY21. As per 2023-24 budget, the government plans to borrow a total amount of Rs 1.43 lakh crore in 2023-24 and repay off Rs 51,331.79 crore. The budgeted outstanding debt stands at Rs 7.26 lakh crore for FY24. This constitutes 25.63 per cent of GSDP in 2023-24.

Though this is well within the 29.1 per cent for limit set by the 15th Finance Commission, every year the state is left with, just about 11 per

In the welfare state, most schemes have been doled out to the entire population. With lack of data to classify, it was easier to apply it to all. This costed the exchequer much. Thanks to Aadhaar, banking penetration and improvements in technology, today, it has become possible to design welfare measures that can guarantee high impact. Since direct benefit transfer, money is credited to beneficiary’s account and this has helped to root out corruption by middle men.

In the recent union budget, Nirmala Sitharaman had also stressed that the government will monitor quality of the financial commitments based on the impacts made. It was the central government’s LPG subsidy scheme that broke the norm and put forth an option for the ‘well-to-do’ population, to withdraw from availing subsidy. Though this was entrusted on individuals’ will, it did trigger a consciousness drive, with several realising their entitlement and giving up on the subsidy.

A foundation for targeted subsidies…

The success of KMUT, will be a model, that has for the first time, used extensive assessment to identify and target subsidy to the beneficiary. In an interview with The Hindu, TN finance minister Thangam Thennarasu mentioned the scheme to be massive data-driven and one of its kind in the country. The state benefits from the advice of experts of the Economic Advisory Council. Flagship schemes are formulated after discussion and it’s benefits show well.

Today the government is the largest data bank. The pandemic has helped to fasten digital transformation and technology has well-integrated into the social fabric. Taking course to latest technologies like AI and data analytics will help the government identify, even a particular individual and the impact of schemes on their livelihood. While KMUT has laid a foundation, it paves way for precision targeting benefits to individuals so that pilferages can be stopped and at the same time the true social impact of the subsidy can be realised.