The audacious adjacencies and expansion plans of Gautam Adani have been eclipsing even the Ambani’s’ and the Tatas.’ We have referred to his modest beginnings in trading coal and power expanded to Mundra port and further to Sagarmala ports; the foray into airports expanding further to a wide range of infrastructure; more recently to green power, cement, steel, telecom, et al. The growth, the range and the size of investments are mind boggling. (See report, IE June 2022 issue). Our finance expert V Ranganathan looked closely into the manner of funding these breath-taking phases of expansion and has raised issues on their sustainability. The concern focuses on 1. A very high gearing – close to 95 per cent debt on modest own funds. 2. Nearly half of the funding in foreign exchange which has its implications on the rupee sliding in value in relation to the dollar. In a separate box item, we point to the pitfalls of building large projects on foreign borrowings, especially when these are invested on infrastructure projects that do not generate revenues in foreign exchange. The recent crash of Dewan Housing and ILFS point to the risks involved. We welcome readers’ views on the Adani phenomenon.

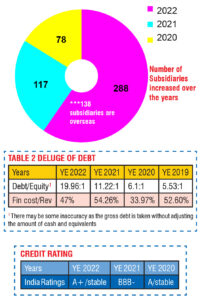

The Adani group has been spreading its wings at a frenetic pace in diverse businesses that range from port/airport management and operations, solar and wind power generation and transmission, mining, natural gas, retail and food processing, infrastructure, cement, steel, mass media… There is no slowdown in investments even during the pandemic (see Graphics). In a short time Gautam Adani has emerged the fifth richest person in the globe. However, the Adani group is sitting on a mountain of debt and it is rising Y-o-Y. It has shot up by 40 per cent to an estimated Rs 2.21 lakh crore in FY22. This article provides some mind-blowing statistics on the finances of the Adani group and on its rising debts over the years. It would be a tight rope for Adani to walk over the rising debts and maintain sustainable and stable growth.

The air is thick with aazadi and amrut. How possible it is for a business to churn the ocean and fetch the amrut that grants it immunity from the ills suffered by normal enterprises?

20/20 vision of audit!

| 1 | Year | 2022 | 2021 | 2020 |

| 2 | Joint Auditor A | local auditor | local auditor | local auditor |

| 3 | Joint Auditor B | One of the BIG 4 | One of the BIG 41 | One of the BIG 41 |

| 4 | Total No of Subsidiaries | 288 | 117 | 78 |

| 5 | Only audited by joint auditor A (Nos) | 183 | 61 | 46 |

| 6 | Value of assets of above (Rs cr) | 32639 | 29025 | 10342 |

| 7 | Not Audited by firms A or B (Nos) | 85 | 29 | 13 |

| 8 | Value of assets above (Rs cr) | 25289 | 3656 | 646 |

| 9 | Total value of Consolidated assets (Rs cr) | 59167 | 28721 | 18425 |

| 10 | % of companies2 audited by both joint auditors | 6.95%3 | 23.08% | 24.06% |

| Note 1 This BIG 4 auditor was appointed for a five year block period but resigned two years ahead after signing the 2020-21 annual accounts. No reasons are found for the resignation of this auditor. The next BIG 4 auditor was appointed for a five year period commencing from FY 2021-22. The local auditor has not changed. The term local auditor is not used in any derogatory sense but only to distinguish from the BIG 4 tribe

2 The percentage is calculated only for the number of companies (subsidiaries) audited by the joint auditors. There is no indication of auditor B auditing any of the subsidiaries. The percentage based on asset value is difficult to compute as the aggregate of the assets of all subsidiaries is not available and the consolidated assets is lower than the aggregate due to elimination of inter-company transactions. 3 This is computed as the residual figure after eliminating the numbers in rows 5 and 7. However, there are a few companies not audited by any auditor and the accounts as prepared by the management is accepted without audit. Since this figure is negligible, the effect of the same is ignored. Inferentially, neither of the BIG 4 auditor audited any of the subsidiaries (other than the % as per item 10 audited jointly) where all the functional assets are held. They seem to have audited only the standalone accounts of the holding company which in essence is like an investment company holding the shares of the subsidiaries. |

Can an entrepreneur unhinge from the common constraints of profitability, debt overhang, credit rating and a trillion trifling troubles that beset enterprises and levitate out of the gravitational pull and take off in full steam?

The go-to-man for a quotation for any narration, William Shakespeare, has this to say of being constrained by thought and conscience the true enemies for action and results!

“… thus conscience doth make cowards of us all, and thus the native hue of resolution is sicklied o’er with the pale cast of thought, and enterprises of great pith and moment with this regard their currents turn awry and lose the name of action… ”

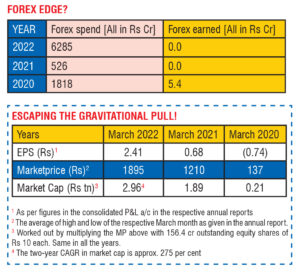

A new kid on the block in the highly hyped domain of renewable energy has defied all customary norms of how a business develops and evolves. He has set up a scorching pace for building/acquiring assets. This frenetic pace raises pertinent questions on the sustainability and robustness of the business model perused. Some critical numbers are provided below to help one appreciate the contours of the above observations.

|

THE RISK OF RUPEE DEPRECIATION… A large number infrastructure projects were built on extremely soft loans extended by multilateral financial institutions like the World Bank, ADB and KfW. These extended funding up to 50 years with a 10-year moratorium, 40-year repayment with low interest of 0.75 per cent. These have been precious in funding large infrastructure projects. Yet these did not factor the steep depreciation in the value of the rupee. I had occasion to discuss this with the German Development Bank, KfW, in regard to its funding the Neyveli Lignite Corporation (NLC). NLC was a project included in the second Five Year Plan (1956-61). KfW extended a billion Deutsche Mark loan that facilitated developing the open cast mines for reaching the lignite seam buried under. Reinbraun lent the expertise and German companies supplied giant bucket wheel excavators and other large mining machinery. At the time of concluding the agreement, the German currency 1 DM was equal to Rs 1.30. Thus roughly the value of the loan extended of DM 1000 million was the equivalent of Rs 1300 million. In my visit to the KfW headquarters in the 1990s, I gathered NLC was prompt in its repayments: by 1990, after availing a 10-year moratorium it was the midpoint of completion of half the loan period. The balance due was DM 500 million. However, the rupee had depreciated steep through the three decades. A DM was now valued Rs 25. This meant the rupee value of the loan outstanding was in the region of Rs 12,500 million, ie. 9.6 times the original rupee value of the loan taken! The plus point of the deal was the ability to construct in quick time large infrastructure projects at then prevailing costs and protecting these against inflation. The negative factor is the risk of steep depreciation in the value of the rupee. NLC, thanks to good management, emerged highly profitable. However, this was not true of several other such projects. For Adani, the advantage is to build large projects at current prices. However, with nearly half the huge debt in foreign exchange, there is the risk of a huge depreciation in the value of the rupee. We live in hope. We do hope, the Indian economy grows rapidly and the rupee remains strong and stable. -SV |

FUNDING A BLINDING PACE OF GROWTH…

How did the company fund the blinding pace of asset growth that defies all conventional norms of annual growth one has historically witnessed in expanding businesses, especially in infrastructure, with a highly regulated sector like power generation where the governmental intervention is high?

The credit rating history, of a higher credit rating with worsening debt, raises questions on the process; the memories of the crash of ILFS which happened ia a not too distant past, should be haunting lenders unless they have some special dispensation protecting their interests. In an era of highly volatile interest rates which is showing more an upward momentum and the vicissitudes in the overall business confidence index, the situation as seen in this case is not an easy one to live with.

The foreign exchange outgo while not directly relatable to the financial structure, may have a content of interest on foreign loans which ties back to the earlier point on the volatility aspect; the foreign exchange borrowings may add to the repayment burden if the current trend in rupee depreciation were to persist.

It is unprecedented that newer entities enter the group at this rate. Many large acquisitions, both here and overseas, have contributed to this phenomenon.

In an environment where the business is moving at stratospheric speed and defying the gravity of common sense the audit oversight becomes most crucial. In most corporate failures due to excesses, audit’ lapses have unfailingly surfaced. The picture below captures some salient issues to assess the robustness of the audit.

The bazaar is looked to for restoring sanity in assessing any type of business as it can easily sift through all details and quickly separate the boys from the men. Has the street endorsed the business model of this enterprise? The current assessment indicates so. Will this hold up and the investors not suddenly served a shock treatment like in DHFL, ILFS and a few other marquee names of the past which are now heaped in the debris of IBC forums?

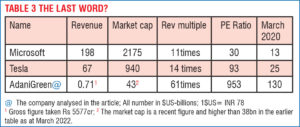

The extent of the unreality of the subject under discussion may hit one squarely in the solar plexus if Table 3 is chewed upon!

With the tiranga being the toast of the times, how does one see the tiranga in this instance?

Adani Green will haunt the mind of banks and investors whether it succeeds or otherwise!