In 2010, WeWork was founded to redefine office spaces globally, reaching a USD 47 billion valuation. Yet, its rapid ascent ended in bankruptcy. WeWork’s story serves as a cautionary tale, emphasising the need for a solid foundation and financial prudence in the unpredictable realm of startup ventures.

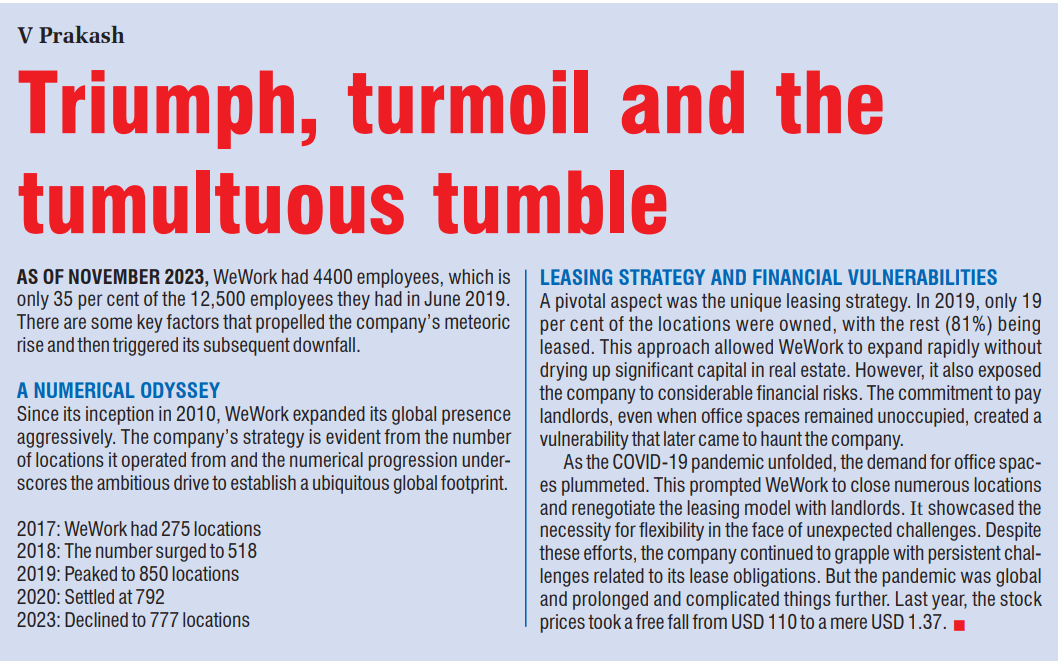

This November, WeWork filed for Chapter 11 bankruptcy, that involves the reorganisation of business affairs, debts and assets. The company went from a valuation of USD 47 billion to bankruptcy in just 4 years. This is limited to its location in the US and Canada. WeWork India has offered to buy back the stake held by the parent company and is currently on a path of expansion.

A sensation that caught on

The company aimed to offer trendy office spaces for rent, fostering a sense of community through free beer and ping pong tables. It was pitched to be a key player in the sharing economy boom by Adam Neumann, the company’s CEO (then). WeWork rapidly expanded and it was this over ambition that ultimately led to it’s downfall.

The initial prospectus, opened with a dramatic pronouncement: “We are a community company committed to maximum global impact. Our mission is to elevate the world’s consciousness.” The inside cover carried a dedication to “the energy of we — greater than any of us but inside all of us” and the section disclosing risks to investors ran to almost 30 pages!

Valuation mis-match

WeWork sounded like a viable product because the concept of shared office spaces was on the rise (still is) and renting a space instead of paying a heavy amount for an office building made sense. Many such coworking spaces can be seen springing up in Silicon Valley and in developing countries like India.

However, there was one thing that had to be addressed. WeWork was never a tech company, as highlighted by a Harvard Business Review article. It lacked the low variable costs, low capital investments and network effects – characteristic of successful tech firms. So even though the business model was solid, the valuation, which was arrived at, based on tech company principles, carried a potential danger since the inception. Further, the company’s business model faced challenges relating to an asset-liability mismatch.

While WeWork committed to 15-year leases, some customers could move out within a month, leading to uncertainties in space utilisation. And due to this fundamental flaw in the business model, the company continued to bleed money. At the time of filing bankruptcy, the assets of the company stood at around USD 15 billion against debt of USD 18.6 billion.

WeWork did not work!

The S-1 filing for the initial public offering (IPO) in 2019 uncovered numerous issues, causing the company’s valuation to plummet. Neumann’s near-total control, questionable financial dealings, and a byzantine corporate structure were red flags for investors. The company simply didn’t explain how it would become profitable. The potential conflicts were staggering, with Neumann having interests in buildings leased by WeWork, personal loans at below-market rates and control over the “WeWork” trademark. Analysts downgraded the company over its profligate spending, exacerbating its financial troubles.

The saving grace was SoftBank’s USD 2 billion investment in January 2019. WeWork’s financial distress became more apparent during the COVID-19 pandemic. Everything happened remotely, so even regular office spaces remained unutilised. In such a case, the demand for flexible working spaces was entirely absent. This ultimately led to downsizing, and the company eventually went public through a Special Purpose Acquisition Company (SPAC) in 2021. It is also to be noted that WeWork had signed the leases at the peak of the real estate market. Players in the co-working spaces who entered the market, post-pandemic, acquired leases that were much cheaper, thereby increasing the overall margin and the cushion for any future losses.

The dream was too good to be true

Like its contemporaries – Uber and Theranos, WeWork had pitched a grand and elaborate dream. And like them, this quickly turned into a nightmare. It just became another glaring symbol of Silicon Valley’s boundless audacity and self-professed exemption from the laws of economics. The lesson is simple. Hippie wisdom, charisma and alcohol can only get you so far. The laws of accountancy catch up to you after that.