Mundra was a natural choice. The north-western port is directly linked to the rich hinterland in the north. The 1800 km distance to Bhatinda has a 438 km advantage over Mumbai and this is carefully leveraged by going for a rail link through imaginative public- private participation. Gautam Adani foresaw the potential of Mundra as early as 1993 and commenced construction in 1996, made it operational in 1998 and obtained special concessions in 2000. The value has been further enhanced by opting for the SEZ status. (From IE, Vibrant Gujarat special issue)

In 2006 I visited Adanis’ Mundra Port. This was part of my visits to Gujarat at the invitation of then Chief Minister Narendra Modi for producing a special issue on Vibrant Gujarat, 2007.

At Adanis corporate office, I met some of the top executives of the group. The sprawling port facilities with huge space for industrial units and exporters was among the most impressive features of these visits. Gautam Adani was part of the galaxy of business leaders who participated in chief minister Narendra Modi’s Vibrant Gujarat meets.

The Adani Wilmar plant at the Mundra Port for edible oils was already well-established. I expressed my sense of awe at the ambitious plans of the group even in 2006.

The genius of Gautam Adani in developing Mundra as a modern port attracted custom not just from the immediate hinterland of Gujarat and Rajasthan but extended right up to Delhi, Haryana and Punjab. With the much larger space available at much lower costs, Mundra evolved in quick time as a large port for bulk cargo and general merchandise like Maruti cars. Today Mundra Taluk houses a 4000 MW ultra-mega power project of Tatas as also that of Adanis’ 5×660 MW plants handling several thousand tonnes of coal every day by the Mundra Port.

The Adanis offers vast land areas for large companies facilitating exports. This helped Mundra Port win custom for export traffic in competition with Mumbai, Navi Mumbai and other western ports.

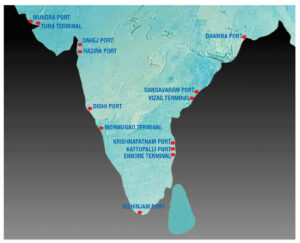

In the following years the Adanis massively expanded port infrastructure around the peninsula. Today the Adanis’ manage several ports in Gujarat and also at Marmagao, Vizhinjiam, Kattupalli, Krishnapatnam, Damra…… strengthening the Sagarmala concept of Nitin Gadkari.

INTO POWER, COAL…

The expansion into the other infrastructure of power, backed by its own large coal mines, the big foray into solar power and later into airports have truly made Adanis the leader in infrastructure. In mid-May, the market cap of the seven publicly traded companies of the group was estimated at over $ 180 billion. The facility to access capital on soft terms and the ability to wade quickly through the procedural bottlenecks are at the back of Gautam Adani’s audacity to think and execute big.

FORAY INTO CEMENT…

In the early 2000s international cement majors like Lafarge and Holcim entered India and were engaged in an acquisition spree. The liberal investment climate and the Indian economy expanding into a higher growth trajectory helped these companies build large capacities in quick time. Aditya Birla group’s Ultratech Cement that acquired the handsome cement capacities of L&T, is another major beneficiary of the boom in construction.

In four decades, the price of a bag of cement in Chennai has shot up from Rs 28 to over Rs 400. In this period cement production has expanded from 18.6 million tonnes to around 380 million tonnes. Capacity additions have been steep and there is the convenient excuse of capacity utilisation continuing to be low, at around 70 per cent, for increasing the prices.

The acquisition of the second and third largest producers of cement – Ambuja Cements and ACC – will add around 71 million tonnes to Adanis present units at Dabhol (Maharashtra) and Dahej and Hazira (Gujarat). Ultratech, the leader, accounts for a capacity of 119.95 MT. The two giants would continue to consolidate their positions by acquisitions. There will also be the focus for green cement in line with the move towards zero emissions. In this the two large groups of Adanis and Birlas will be better placed, especially the former with its large capacity of renewable energy.

NOW TO HEALTHCARE…

Gautam Adani announced the intention to enter the healthcare sector with an allocation of around $4 billion. The plan seems to include acquisition of large hospitals as also pharma units.

Pharma retail has evolved as a highly lucrative trade. With increasing longevity, age-related medical needs keep expanding. Hospitals, druggists and pharmacists have routinely been charging maximum retail price (MRP) of pharma products. Enterprising start-ups like 1 mg, Netmeds and PharmEasy became quite popular and recorded big growth in quick time through efficient and effective overnight deliveries and handsome discounts.

Reliance identified the potential and acquired Netmeds. There was a big fight for custom by massive promotion through TV. Tatas, with its aggressive race to win larger consumer space, acquired 1mg. There was consumer delight with liberal discounts of 20-25 per cent on MRP offered by the e-pharma companies. Apollo Hospital Enterprises routinely charging MRPs on the captive custom of in-and out-patients and at its dispersed pharma outlets, was understandably shaken and jumped into the e-commerce space, promising delivery in a couple of hours.

Now you understand the interest of Adanis who think big and execute fast. PharmEasy, known for its extensive TV promotions, could be sharpening its tools for a booster shot.

Finance analyst V Ranganathan points to the formidable task for the Adanis:”it is true the group has the facility to mobilise funds on soft terms from overseas. Still, Adanis will need to earn around Rs 12,000 crore surpluses from the Holcim plants that presently generate around Rs 4000 crore of profits. It is also necessary to factor the steep depreciation in the value of the rupee against the dollar in accessing foreign funds on a large scale,” he said.

There are great expectations on the massive Gati Shakti plan for infrastructure and the huge programme of housing promising a house for everyone. More important is the ability of the Adanis to manage the government.

Please click the following links to read other articles of June 2022:

Russian petrol for western Europe and even the US!

A sleepy township morphs into an industrial hubA sleepy township morphs into an industrial hub

Everything gigantic in Dubai – Dubai Travel by SV

Sweet News on the Sugar Sector

Conference with New CII President Sanjiv Bajaj

Women forge ahead – Recent civil services examination