Include inflation control as part of CSR

Companies that make handsome profits for years could have the social concern to reconcile to a dip in profit and help in price stability during a Covid-19 like year of decline. Such an act will be more invaluable to its consumers than the mandated contribution to CSR or to the PM Care/CM Care donations.

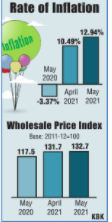

At the initial lock-downs of the Covid-19 pandemic in 2020 due to lack of demand, there was a dip in inflation to – 3.37 per cent. This was a temporary blip. IE cautioned the risk of prices shooting-up and inflation zooming. Sadly this is happening now. The inflation in mid-May 2021was at 12.94 per cent.

The price increase has spread across commodities, finished products, services… I cite a few instances: price of tur dhal has shot-up by around 50 per cent from around Rs 95/kg to around Rs 135/kg. Edible oil has recorded even steeper price increases. Soaps to a vast range of products have recorded sizable price increases.

Construction materials have recorded even higher increases: steel by over 30 per cent and cement close to 20 per cent. In sync, a range of other building materials, including bricks, paints, sanitarywares… have recorded sizable increases.

Sharp rise in prices of aluminium, steel…

Manufacturers of auto components pointed to sharp increases in the prices of aluminium, steel and freight charges: of steel from Rs 38,000/tonne to Rs 65,000/tonne, of aluminium from Rs 140/kg to Rs 220/kg and freight cost per container load to US from USD 2800 to USD 6600.

There have been steep increases in the prices of domestic appliances, two-wheelers, cars…

Steel manufacturers attribute price increase to increases in the prices of iron ore and steel scrap; likewise aluminium manufacturers blame it on the increase in the price of ore, bauxite.

Anticipating the effect of such increases, the government should have stepped in to contain the increase in the price of ores. They could have adjusted the duties to ensure price stability and moderated export of ores.

TN cement producers cartelise again…

Business leaders on their part could have exerted to contribute their mite to maintaining the prices. I cite the instance of reckless increases in the price of cement in Tamil Nadu. For a while the increase was from around Rs 400 to Rs 520 per bag at the retail end which was moderated a bit on the intervention of the Chief Minister. With limestone mines under the control of most large manufacturers of cement, there is little warrant for such steep price rise in a short time. There are more paradoxes: the price of cement across the border in Andhra Pradesh was just around Rs 370/bag. Yet all cement manufacturers jacked-up prices in Tamil Nadu.

I was looking at the finances of India Cements which sets the trend for such sharp price increases in Tamil Nadu. For a decade, the company has been recording handsome growth. Consolidated revenue from operations was Rs 4551 crore as on 31 March 2021. On this the company recorded a net profit of Rs 206.77 crore [FY21]. Related to the paid up capital of Rs 309.90 crore the reserves were at Rs 5396.77 crore.

The company reported a profit Rs 50.16 crore for the year ended March 2020: but in 2021, despite a decline in total income net profit had zoomed four times.

Companies that make handsome profits for years can have the social concern to reconcile to a dip in profit and help in price stability. Such an act will be more invaluable to its consumers than the mandated contribution to CSR or to the PM Care/CM Care donations. – SV