Banks have got accustomed to swallowing the bitter pill in bad loan cases. With every other IBC resolution popping out of the NCLT, the level of recoveries keeps plumbing new depths.

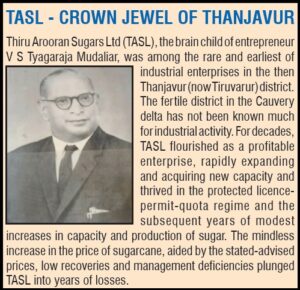

Thiru Arooran Sugars (TASL) is the latest addition to the trophy cupboard of the public sector banks (PSBs) displaying mighty resolutions with measly recoveries to the banking system.

The company that owned 8500 TCD crushing capacity between its two plants in TN and Andhra together with a 60 KLPD distillery and co-generation facility of about 50 MW was referred to Corporate Insolvency Resolution Process (CIRP) under the Insolvency and Bankruptcy Code (IBC) by the banks in 2019. The parent had investments in a subsidiary and an associate company to carry on the overall business mentioned above.

The approximate liabilities admitted in the CIRP was about Rs 1580 crore and bank loans of Rs 1454.58 crore constituted the lion’s share of the same. Dues to operational creditors, employees, farmers, PF and other statutory lenders formed the rest.

BANK FUNDED EQUITY GAP AS UNSECURED LOANS!

The shocking revelation is that about Rs 1000 crore of the bank loans were unsecured. IDBI Bank, Canara Bank and PNB, each had well over Rs 100 crore under this category. The presence of Canara Bank in this list is most surprising as IDBI and PNB have a formidable reputation of getting conned time and again!

The company was incurring losses from 2013-14 itself. It is not clear as to how the account was being handled from then on and why the CIRP was commenced only in 2019 even when the law had come into force in 2016. Quite possibly, the company kept stringing stories of recovery like most discredited corporates which caused the run of bad bank loans over the last decade or so did.

The quantum of loans the group enjoyed looks seriously disproportionate to the scale of operations carried on. It is not clear how the banks continued funding and whether any forensic investigation has been commissioned to check the diversion of funds if any.

It is yet another case where the promoters have failed to bring in adequate equity from their side nor the banks seemed to have applied pressure to dilute the promoters and bring outside equity. Practically the banks were funding the equity gap as unsecured loans!

MOCKERY OF INSOLVENCY RECOVERIES…

Initially, the NCLT had ordered liquidation of the company. During the process, KAL Distilleries Pvt Ltd, a relatively new face from the hinterland of TN, emerged to take over the undertaking of TASL under a scheme of arrangement formulated under IBC and the Companies Act 2013.

KAL scheme has secured the approval of the NCLT which facilitated the takeover of a fully integrated sugar mill with a distillery, huge land bank and accompanying assets at a throw away value of Rs145 crore as settlement to the creditors and Rs110 crore to be infused as fresh cash into the company.

BANKS TO GET Rs 4.99 CRORE FOR THE Rs 1000 CRORE LENT!

The unsecured bank loans of about Rs 1000 crore are settled with a princely sum of Rs 4.99 crore payable over four quarterly instalments! For example, for Canara Bank the amount that will be received over four instalments will be an incredible sum of Rs 58 lakh against an outstanding of about Rs 115 crore. The recovery constitutes about 50 paise in hundred rupees! The bank may be spending more in management cost for getting this than the amount recovered! The same applies to the rest of the pack.

The secured lenders get Rs 80 crore over a five-year period against Rs 458 crore outstanding! The IBC lawyers and consultants get a far higher amount (Rs 8 crore + an unquantified liquidation cost) than all the unsecured bank lenders do! This may be setting a new dubious benchmark in this field.

Banks go scot-free yet again with little accountability for cavalier lending. The role of the Chairman, experts like Chartered Accountants on the board, RBI appointed directors and the rest of the top management again comes under scanner for pampering promoters who, like Alibaba, say ‘open sesame’ and end up helping themselves to as much as they need from the magic cave!

MASSIVE TAX BENEFITS…

The settlement is expected to deliver significant tax benefits to the acquirer as all the losses incurred by the CD is available for set off, though they get it for paying a trifling amount to the creditors. While the full extent of the tax benefits cannot be gleaned from the documents, experts believe it is definitely in excess of the amount paid to acquire the assets.

YET ANOTHER SHADY CORPORATE TAKEOVER…

Practically, the resolution applicant can eat the cake and keep it too! Thus, the rest of the poor taxpayers subsidise yet another shady corporate takeover. There could not have been a sweeter deal to any acquirer, even if the sugar mill is moth balled and sold as scrap as global steel prices are touching new highs!

And banks swallow a mouthful of the ashes of the burnt bagasse and gulp it with a glass of ethyl alcohol that the distillery will churn out very soon!

Of course, the bank chairmen and directors would be grazing fresh pastures elsewhere!