Now that things have settled down, read through this article as it cuts through the post-budget hype with a sharp analysis of historical budget data.

Decoding a decade of budgets

The present regime has maintained continuity in office over a decade, and the data available helps to place in perspective how the decisions taken during the past dozen budgets have shaped the economy. Of the fourteen budgets in this period, eight have been by the incumbent finance minister, Nirmala Sitharaman, and five by the late Arun Jaitley. A rare record, perhaps, for any dispensation!

Right from assuming office in May 2014, there has been a continuing policy thrust to promote manufacturing, Make in India, boost the small and medium industry, and promote Atmanirbharta. All the budgets presented over the years included many policy announcements touching on these areas. It has also reduced and restructured corporate tax and introduced direct subsidies to businesses through the PLI scheme. The latest budget also contains the usual quota of assurances to support MSMEs and manufacturing.

In this context, it is interesting to look at the data on corporate taxpayers available for a decade, to assess the outcome of the policy choices made over time. However, to understand the progress of the MSME and manufacturing sector only through the prism of corporate taxpayers may be less than perfect. But the data available pertains only to the corporates.

MSMEs: Small But Still Struggling?

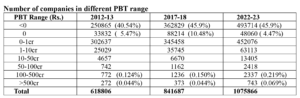

Table1 below gives the data of the number of companies who filed the tax returns

at different levels of profit before taxes in the period between 2012-13 till 2022-23,

the latest financial year for which data is provided in the 2025-26 budget

annexures.

The choice of 2012-13 is to capture a ten-year horizon, though the said year falls

outside the period of Narendra Modi headed government.

The category < 0 PBT is easy to understand as these are loss-making companies. The ‘0’ category is not easy to figure out, but the government data follows this pattern. It is difficult to conceive that so many companies reported an exact zero PBT! But this doesn’t impact the analysis.

The first aspect that may strike the eye is the sharp rise in the number of companies reporting book losses. The number has grown significantly (doubled) since 2012-13. The number of companies with more than Rs 10 crore profit has increased from 1.04 per cent in 2012-13 to 1.75 per cent in 2022-23. The growth seems reasonable over a ten-year period. However, for the country to become an economic powerhouse and achieve a GDP and per capita income five times higher by 2047, the number of companies in the midsize range (Rs 10 crore – Rs 100 crore) will need to grow much faster. Even Rs 100 crore in USD terms is insignificant and may count for nothing in the eyes of foreign investors or global partners.

Corporate Taxpayer Data: The Numbers Tell the Real Story

This data is useful to understand if the policy prescriptions directed at the MSME sector are helping that segment grow and letting new entrants come into the fold of doing business. There may be differing perceptions on interpreting this data. Companies making profits up to Rs 10 crore, most likely to be MSMEs, have in the ten years lost their share of total PBT from 9.91 per cent to 8.02 per cent.

Does this mean that MSMEs are not benefiting from the push and policies highlighted in budget presentations? Or is it that the MSMEs of the past have grown and evolved into larger companies, and therefore the policy is working well? Do make your own conclusions!

Additionally, the Rs 10-50 crore range shows a marginal decline from 9.27 per cent to 8.99 per cent. The ones grabbing a greater share of the bottom line are those at the bottom of the table! While an increase in the number of companies with more than Rs 500 crore PBT is quite necessary for the speedy growth of the economy, it may not be ideal that their share in the PBT also grows. This may indicate a concentration of economic power!

From Small Fry to Big Fish: The Rise of India’s Corporate Giants

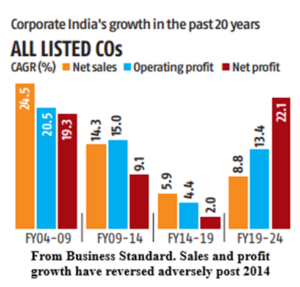

With the corporate taxes having been brought down in September 2019, there is an observable, though marginal, change at each line item. However, it is interesting that the overall Effective Tax Rate (ETR) is almost unchanged over this decade!

The concessions that existed in the past let the ETR go down from the headline tax rate. The new approach has been to eliminate concessions and keep the headline rate lower. The mega tax concessions in 2019, which the Opposition decried as a giveaway to business, were actually not.

Tax Cuts & Reality Checks: The ETR Rollercoaster

* Higher effective rate is due to factoring in the taxes paid by companies having zero profit before taxes

(The figure of 29.49 per cent as ETR in 2017-18 is due to some adjustment in the figures reported and anyway that number is not very critical to draw any inferences from this table.)

The companies with profits greater than Rs 100 crore have remained at the lowest ETR in the overall corporate taxpayer universe. That situation prevailed pre-2014-15 as well, and not a recent creation.

Where’s All the Money Going?

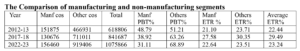

Table 4 cuts the corporate tax data between manufacturing companies and other businesses. This data is quite important to appreciate how far the policies promoting manufacturing have worked.

The share of manufacturing in the total corporate profits, which was 48.79 per cent in 2012-13, has reduced to 31.11 per cent in 2022-23. Government sources should dissect this clinically and examine what has caused this lopsided distribution where manufacturing has lost its primality.

The ETR of both manufacturing and other sectors has hovered around a small range over the ten-year period. The ETR of manufacturing has slightly moved up in 2022-23 compared to 2012-13.

Manufacturing Decline: The Disappearing Act of Industry’s Golden Goose

Should manufacturing get some specific tax props, and others, like financial companies, be subject to a higher rate, so that there is a conscious cross-subsidy?

The new tax law, which the FM smartly postponed by a week as its introduction could have marred the excitement of the tax cut, should ideally consider the significance of the data analyzed here and seek greater public consultation.

Upfront consultations in framing the tax policy should replace the secrecy in cooking the changes. Palkhivala gave his last speech on the budget almost thirty years ago, and said that budgets should be once in two years and should not be prepared in secrecy and unveiled suddenly on a fine morning (evening in those days) like a magician pulling a rabbit out of the hat!