- Capital investment

- Lower and middle class

- Women Elderly Farmers Working class

- Super rich

- And others

Nirmala Sitharaman presented her fifth budget that marks the full and final budget for the ruling NDA government. It checks all the boxes, covering people across a wide range.

This budget’s focus is more about reviving the growth through capital investment and creating liquid cash in people’s hand to spend. At the same time, it tries to pull out, the rest of the 220 million out of poverty and addresses the growing old population as well as burgeoning youth. This shows that the budget takes into consideration both the problems of today and also understands the future. At the 100th year of independence, India envisions to be both empowered and inclusive. It aspires to transform into a technology-driven and knowledge-based economy. This budget has set the stage for the change.

Inclusivity at the core

A day before, when the Economic Survey was released, it assured that India is on the path to reach USD 5 trillion ahead by 2025-26 and USD 7 trillion by 2030. It also predicted a growth rate of 6.6 per cent assuring the world’s hope on India, as the fastest growing economy of this decade. For this growth to be wide spread and well-benefitting, the core theme of the budget is empowerment and inclusivity. It has identified four areas that would play a major role. The foremost is empowerment of women, especially rural women. The next is uplifting the marginalised communities. Third is the focus on tourism, both for revenue and job creation and the final major one is green growth that would help reduce the carbon intensity of the economy.

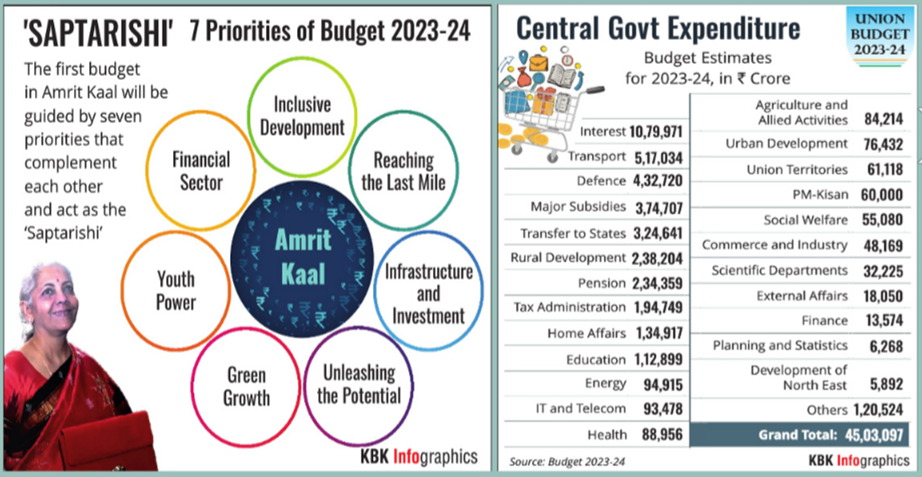

Saptarishis – the guiding force

The four core areas will be achieved through guided measures with seven priorities: Inclusive development, reaching the last mile, infrastructure and investment, unleashing the potential, green growth, youth power and financial sector.

Fiscal Responsibility

The government is bound to progressively reduce its debt, revenue and fiscal deficit. It has reiterated the target to reduce fiscal deficit below 4.5 per cent of GDP by 2025-26. Fiscal deficit indicates the government’s borrowing and it stood at 6.4 per cent for 2022-23 and projected to be 5.9 per cent in 2023-24. Similarly revenue deficit which denotes excess of revenue expenditure over the receipts, stood at 4.1 per cent for 2022-23 and estimated to be at 2.9 per cent in 2023-24.

Outstanding liabilities indicate the accumulation of borrowings over the years. It has been declining from 51 per cent in 2012-13 to 48 per cent in 2018- 19. From 2019-20 onwards, it has been increasing and reached a high of 61 per cent in 2020-21 but declined to 57 per cent in 2021-22. It is expected to remain at the same level in the forthcoming years too.