The Indian insurance industry has changed vastly over the course of years. 2022 proved to be a reformatory year for the General Insurance (GI) industry. The main triggers have been the push for insurance for all by 2047 and introduction of online insurance marketplace Bima Sugam. IRDAI is focussed to ensure a customer first approach and this has changed the game.

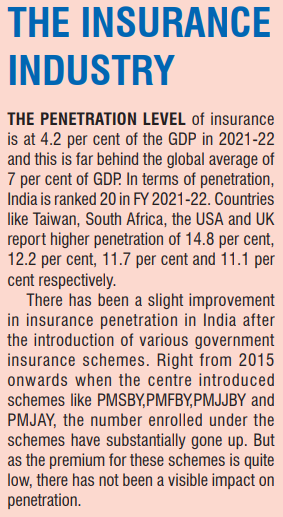

The insurance industry in India is expected to reach USD 200 billion by 2027. GI is forecasted to grow by 11.4 per cent in 2023 in terms of Gross Written Premiums (GWP). Strong economic growth, favourable regulatory developments and rapid digitalisation are the major factors triggering this. According to GlobalData, GI industry will grow at a compound annual growth rate (CAGR) of 9 per cent from USD 38.1 billion in 2023 to USD 49.2 billion in 2027, in terms of GWP. In India, insurance is considered as an additional expense and opted very rarely. With changing demographics, the impact of the covid pandemic and several government insurance schemes, the awareness has considerably increased. The industry stands at an important juncture in its next phase of growth.

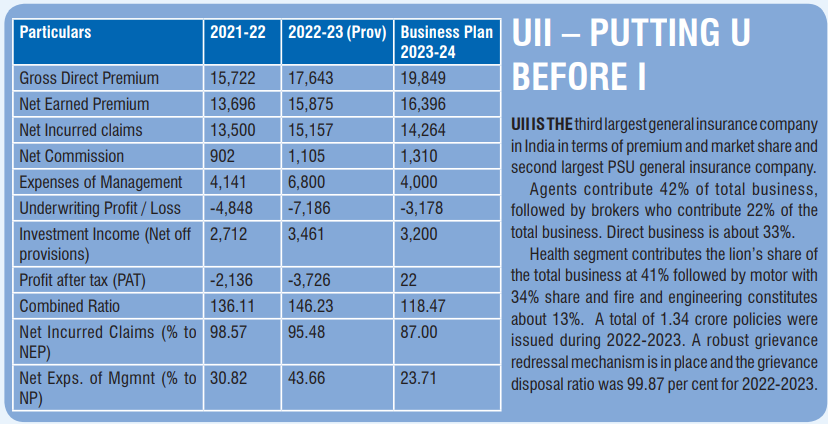

IE spoke with Satyajit Tripathy, CMD of United India Insurance (UII), an 85-year-old public sector general insurance company to know more about UIIs plan in this decisive phase.

“UII completed a total premium of Rs 17,643 crore with a growth rate of 12.22 per cent and an accretion of Rs 2206 crore. Tremendous progress has been made in use of technology for the distribution of products and servicing of claims. We have a 100 per cent digital process in place for handling of motor claims,” said Tripathy. For UII, health contributes almost 41 per cent of the business followed by motor at 34 per cent and fire at 10.66 per cent.

Digital Focus

Technology has been a major enabler in the insurance industry. With digital transactions increasing by the day, investment in technology is critical in optimising operations. UII has leveraged technology for operational efficiency and to deliver better customer service. “Our IT budget for the financial year 2022-23 was Rs 178 crore, which is 1 per cent of gross direct premium (GDPI). The budget allocated for the financial year 2023-24 is Rs 205 crore,” said Tripathy. UII is planning to consistently increase its IT spend to 3 per cent of GDPI for the next 3 to 4 years. It is also planning to rope in a technology consultant to ensure efficient and effective adoption.

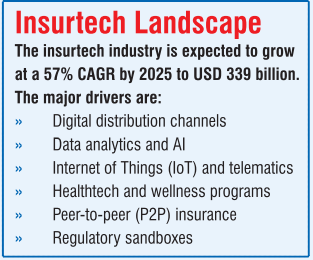

Today, many insure-tech organisations provide readily available and reliable solutions that can be incorporated in traditional business models. Recognising this trend, IRDAI, recently allowed an additional allowance towards insurtech and insurance awareness expenses. “This regulation allows spending to the extent of five per cent of the allowable expenses of management,” highlighted Tripathy. It provides an opportunity for traditional companies to embark on their digital journey.

UII has identified areas of improvement to increase efficiency. The first one is process automation. With manpower constraints, automation in recurring processes will help to deploy people to critical areas like customer service, faster claim settlement,… The next focus is on digitisation to upgrade service offering through portals and mobile applications. “We are also investing in AI and ML. This will enable us to move towards data driven decision making. We will be able to offer tailor made covers to all customers and also extend to AI driven claim settlements so that the claimant itself can assess simple motor claims. This will result in quicker claim settlement and happy customer,” pointed Tripathy. Another major area is fraud analytics where UII is looking to collaborate with other industry partners.

Increasing cost of hopitalisation…

Hospitalisation has become a costly affair. Without insurance, it has become almost impossible. But the problem arises when high charges made by hospitals leads to increases in the insurance premium. The biggest challenge in controlling costs in health insurance is that there is no standardised rate for different procedures and it differs from hospital to hospital and from city to city. “Hospitals increase their schedule of charges very frequently in the name of medical inflation. The insurance companies try to bring in a balance by empaneling major hospitals, where by amounts are frozen for major ailments and procedures. This not only prevents misuse and abuse of overcharging but also quickens the turnaround time taken for disposing cashless requests. Unfortunately, for reimbursement claims the hospitals charge whatever they want and it is much higher than the package rates which have been decided between hospitals and insurers,” said Tripathy and continued, “there is a strong need for a regulator for the hospitals to have a better control on the costing without compromising on the quality of care provided.”

Simple and low-cost products

The growth of insurance industry in India is hindered due to lack of awareness. It is still perceived as complex and expensive. Trust is also a major factor as the customer is often unsure if claims would be honoured. “Even today many people cannot afford insurance. As an industry, we need to work towards low cost, simple and easy to understand products,” said Tripathy. Increased digitisation has also resulted in advanced frauds with higher spending for secure systems. “As the Indian customer is very price sensitive and looks for more value adds we have been designing more low-priced covers in property and health insurance, explained Tripathy.” UII is planning to come out with new products for cyber security and health and these are designed to suit the needs of the younger population.

Technology at core of operations…

In line with IRDAI’s insurance for all theme, UII is planning to expand awareness amongst rural people. UII has about a dozen micro insurance products which are targeted at the marginalised sections of the society under social security.

In the coming 5-10 years, UII is looking to foray much deeper into the health Insurance segment. Yet another area is innovation in product packaging and digitising entire operation for effective last mile delivery of products. And to manage both cost and fraud, AI driven by data analytics will be the core. – Jayanthi Raghunathan

—————————————————————————————————————————————————————————————–

Covering all odds…

In the last several months, the insurance sector has witnessed a lot of activity. While some of the changes have happened in the normal course, a number of new changes are being brought in by the regulator, IRDAI. A roundup on the major changes.

Cap on marketing expenses

Cap on marketing expensesThere were two limits with regard to expenses imposed. One was a limit on the fees or commissions payable to marketing intermediaries like brokers, agents etc. The other was a cap on the total expenses of an insurance company. Both were percentages linked to the premium. This was to restrain insurers from unbridled spending and protect the interests of policyholders, shareholders and other stakeholders. High spends could lead to increased premium for policyholders, and also result in companies becoming financially fragile.

Few months back, there was a probe by GST authorities on evasion of tax by insurance companies. Later, the income tax department also commenced probes. This was because marketing intermediaries were supposedly paid amounts higher than permitted limits by showing them as various services.

The limit on marketing expenses has been now withdrawn. There is only a single expense limit for the company as a whole. The company can frame its own policy for remunerating marketing intermediaries and other expenses. This would no doubt provide a big relief at least for some insurance companies who are facing probes by GST and other authorities for tax evasion.

This also raises the question whether the removal of the cap will result in differential payments to intermediaries. IRDAI has indicated the need for fairness in fixing remuneration for intermediaries to promote transparent competition among them. For group policies they have said that there could be a cap on commission.

Among the various marketing channels the share of business brought in by lakhs of individual agents has been the highest. Brokers, who came in the last two decades, have steadily grown in strength and have now overtaken agents in business procurement. This does not augur well for agents and the future may see the financially stronger brokers, corporate agents, banks, etc edging them out. The regulator should have a look into this aspect as this pertains to the livelihood of lakhs of individuals.

From holding 100 per cent market share 23 years back, the share of business has been dropping. This was only to be expected with many new companies entering the fray. Still, psychologically, market share falling below, the one third mark is certainly an event to be noted. The share from the time the market opened up in 2000 had been steadily falling for the PSUs and perhaps they were only able to slow the pace of fall in some years. While market share may not be the only relevant factor, yet it is necessary to maintain a healthy share.

PSU insurers ought to take strong steps to protect their turf. The owners, ie. the government, gives the impression of not being clear on how to handle these companies. Conflicting and confusing signals have come in the last many years. From talking about merging of all the four companies to various combinations, many thoughts have made the rounds. The companies have been losing ground both in terms of business volumes as well as financial strength. Three of the four insurers have their solvency badly affected. Of course there have been some capital infusion done by the government and some more are in the pipeline.

Contributions to life insurance policies was being misused by some individuals to take advantage of the loop holes in the income tax act. To plug this, the budget brought in a restriction on the maximum premium payable to avail tax exemption from income under the set policies. This has now been fixed at Rs 500,000 per annum. This is expected to affect life insurance companies negatively.

Some more changes which would alter the structure of the industry have been proposed and awaiting placement for parliamentary approval.

All these years, there has been a clear demarcation between companies involved with life and non-life insurances and companies have to seek licenses to operate in only one field. This is on account of the complete difference in nature between the two. This distinction is proposed to be done away with and a composite license is sought to be issued to those desiring it.

Many business groups have companies operating in both the fields. Would this move be a precursor to mergers of such companies and emergence of huge insurance behemoths?

All these years there have been set norms about investment patterns of insurance companies. Currently 50 per cent of the investment is to be made in specified securities. It was at one time as high as 70 per cent. The proposal is to make it flexible with powers to the regulator to amend keeping in view the market dynamics.

Banks are already doing this. So why not insurance companies appears to be the logic. Ostensibly this would open wider offerings to their customers while opening new revenue streams for the companies. This could benefit companies which are part of business groups having operations in other financial fields, like Bajaj, ICICI etc.

The National Health Authority (NHA) has initiated under the Ayushmann Bharat Digital mission, the concept of a health insurance exchange. The attempt is to digitise, standardise the ecosystem and move from a substantially manual process. It is their belief that this would reduce the cost for all the stakeholders, make it easier for tracking of claims and thereby improve the trust factor. The chairman IRDAI is reported to have urged general insurers to adopt this and given a target date of 01 August, for commencement.

This is conceived as an online marketplace for buying and selling of insurance policies. According to IRDAI, this would be a UPI like moment for the insurance industry. Originally targeted for January 2023, it is now proposed to start from 01 August. The industry councils have been roped into this project.

An important benefit that could accrue to policy holders could be reduction in premium to the extent of intermediary commissions. The companies could give lower rates when premium is routed through the portal. This would be possible since there would be no intermediary involved and therefore the saving on commission costs can be passed on by the insurer directly to the policy holder. What would be its effect on the intermediaries is to be seen. Since the project is huge, it is possible that it may come out in phases with maybe one or two products taken up initially.

The thought process also involves facilitation in settlement of claims. But this could be somewhat more complicated than buying and selling of policies. It would be interesting to watch the developments with regard to the portal. – KB Vijay Srinivas