On the surface of it, finance minister Nirmala Sitharaman halving the budget of PSU oil marketing companies (OMCs) looks like it will hurt them. However, with a closer look, one can argue, she is fully justified.

In last year’s budget, FM provided Rs 35,000 crore for OMCs – Rs 30,000 crore for energy transition projects to net zero and Rs 5000 crore for purchase of strategic oil reserves (SOR) to fill caverns at Mangalore and Vishakhapatnam.

Why subsidise OMC on energy transition?

As far as Rs 30,000 crore for energy transition, there should have been questions raised – why should the government support profit making oil companies in the first place? One may wonder how can anyone question any support to green project for energy transition. If a company is not money making and incurring losses because of government policy, then budgetary support for green projects can be fully justified. But in the case of those that are expected to earn profits, it is difficult to justify any budgetary support.

Is budgetary support necessary?

Since this was caused by direct or indirect interference of the government to force them to hold the prices unchanged when crude oil prices were high, government might have felt the need to give budgetary support.

Even this argument can be questioned. When the budget was getting ready in 2022, OMCs were not losing money. In the past, when oil companies sold products at below market price, government reimbursed the losses. Such a payment is considered as subsidy. Now a non transparent method of budgetary support seems to have been developed and it is not healthy.

Dynamics of fuel pricing

The government had reduced the central excise duty twice, on 4 November, 2021 and 22 May 2022, effecting a cumulative reduction of Rs 13 and Rs 16 per litre for petrol and diesel respectively. Such tax reductions were passed on to consumers by OMCs.

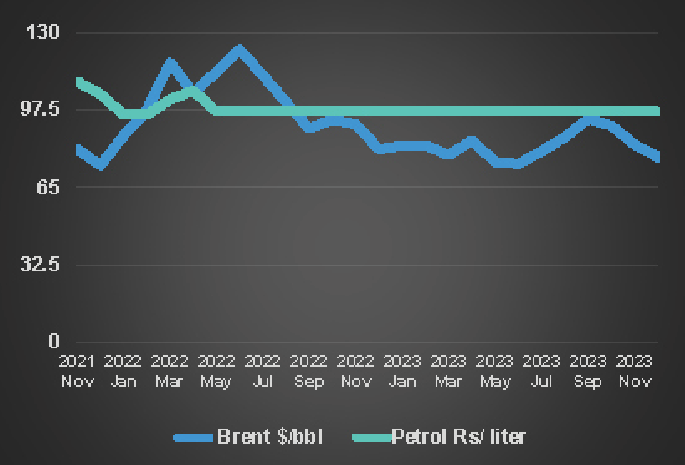

Petroleum Minister has stated on several occasions that OMCs have all the freedom to change prices, to reflect market development. They were even changing prices every day to reflect world oil market since 2017. However, OMCs froze fuel rates for 137 days beginning early November 2021, when five states were to face polls. Despite having freedom to change prices, why OMCs did not do so even after price rise due to Ukraine war, needs to be analysed? As a result, they lost huge amount. But when it started to come down later, in the second half of 2022 and also in 2023 (Brent prices moved between a band of USD 80/b to USD 90/b excepting for one month in 2023), OMCs kept the prices unchanged to earn profits and compensate for the losses incurred. They earned a sizable profit of Rs 516 crore in the first half of 2023 as against the loss of Rs 272 billion in the first half of 2022.

Predatory practice by PSU OMCs?

It is to improve profitability of OMCs, FM has decided to halve the budget support. As discussed earlier, one should even question the need for same as OMCs have the flexibility to change prices. If there was apparently no government pressure to maintain prices, were the OMCs trying get market share from private oil companies? Then this is predatory pricing. Even now, the petrol price in Delhi is Rs 96.72 and has remained the same since June 2022! Unlike public sector oil companies, private companies cannot afford to lose money. In fact, they diverted their product to export market and government then imposed restrictions. Halving the budget for OMCs is raising several questions which were totally unexpected!