The ambitious and much awaited new Foreign Trade Policy (FTP 2023) was unveiled by the centre recently. It is aimed at creating a responsive framework to achieve larger market share in international trade. While the end date for the policy has not been specified, the government has said that improvements as per industry needs would be done when deemed necessary.

Reiterating the government’s focus on Atmanirbhar Bharat, the new trade policy will play a critical role in facilitating India’s transition to a developed economy. It seeks to boost the country’s exports to USD 2 trillion by 2030 and contemplates international trade settlement in INR. The government proposes to set sector-specific targets to increase exports from the current USD 450 billion. New FTP contains some welcoming features on enabling larger e-commerce, establishment of district exports hubs and merchanting trade reforms.

Foreign Trade, a Report card

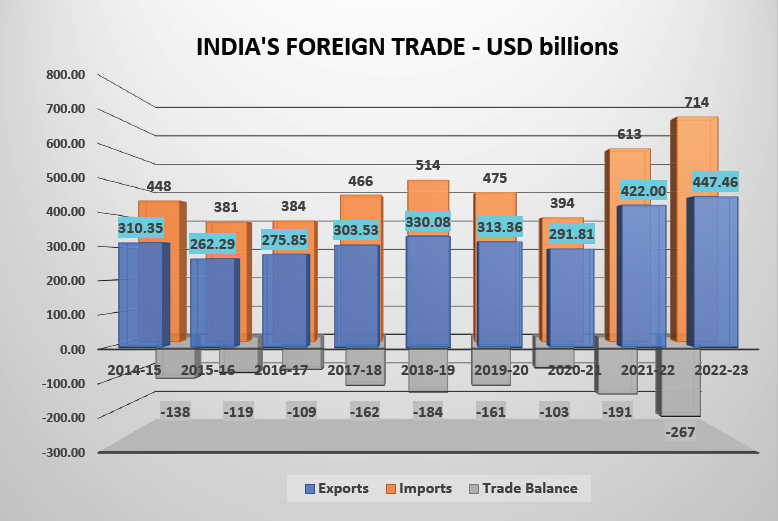

Exports which were at USD 310.35 billion in March 2015 has grown to USD 447.46 billion in March 2023 registering a growth of 44 per cent. Import grew from USD 448 to USD 714 billion, clocking a growth of 59.4 per cent. The trade deficit has grown from USD 138 to USD 267 billion, a rise of 93.5 per cent over these 8 years. Higher import implies larger imported inputs in export products as well as a pointer to our economic growth.

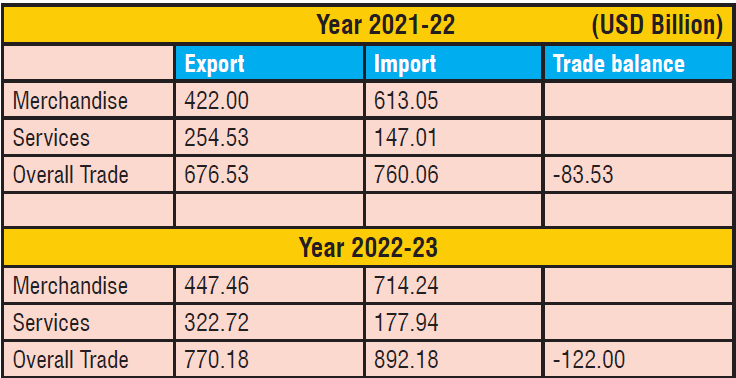

India’s overall export in FY 2022-23 is about USD 770.18 billion, (exhibiting a positive growth of 13.84 per cent over FY 2021- 22) and is the highest achievement by the country ever. Overall import in FY 2022-23 is around USD 892.18 billion, exhibiting a positive growth of 17.38 per cent over FY 2021-22. In the past 6-7 years, India’s export has risen by about 75 per cent, as compared to 28 per cent at the global level.

A fillip to Indian exports

The power that exports’ earnings give a nation cannot be understated. Foreign exchange helps reduce the trade deficit and has a direct impact on the GDP and economic growth. Exports also generate employment (our unemployment rate being 6.9 per cent).

MSMEs are a large employer. The FTPs focus is to encourage MSMEs to expand globally, increase competitiveness of Indian brands and positions India as a leader in the global marketplace. At the same time, ecommerce is helping them in a big way, to cater to the discerning clients abroad for custom-made products. As per NASSCOM estimate, a USD 125 billion e-commerce business is waiting to be tapped by 2030.

Rupee as an international trade settlement currency

This will benefit the MSMEs greatly as these are small value exporters who can reduce conversion charges and transaction costs and lead to better realisation for their exports. It will avoid exchange fluctuation loss and help in quicker realisation also.

MSME the backbone

The MSME sector has emerged highly vibrant over the last five decades contributing significantly to economic and social development by fostering entrepreneurship and generating large employment opportunity at comparatively lower capital cost next only to agriculture. It contributes to inclusive industrial development by nurturing ancillary industries and encouraging women entrepreneurs.

As per the National Sample Survey, during the period 2015-16, there were 633.88 lakh unincorporated non-agriculture MSMEs in the country engaged in different economic activities (196.65 lakh in manufacturing, 0.03 lakh in non-captive electricity generation and transmission, 230.35 lakh in trade and 206.85 lakh in other services). Micro enterprises accounts for more than 99 per cent of total MSMEs. Out of the total, 324.88 lakh MSMEs (51.25%) are in rural areas and 309 lakh MSMEs (48.75%) are in the urban areas. MSME sector has been creating 11.10 crore jobs.

After the last policy, some major changes have been brought about in MSME administration and management. The very definition and classification of MSMEs has undergone change. As per new definition, micro industry is one where investment in plant and machinery does not exceed Rs 1 crore and turnover not exceeding Rs 5 crore. While for small and medium units, these limits are Rs 10 crore/50 crore and Rs 50 crore and 250 crore respectively. Export turnover is excluded from the turnover calculation for the above purpose.

The new definition has removed the difference between manufacturing and service industries. This has been done, to be realistic in keeping with the changing times, recent economic advancements and to establish an objective system of classification to provide ease of doing business. This change itself is expected to bring about many benefits that will aid MSMEs grow in size and provide a major relief to exporters. Further, in case of an upward change in terms of investment in plant and machinery or equipment or turnover or both, and consequent re-classification, an enterprise shall continue to avail of all non-tax benefits of the category it was in before the re-classification, for a period of three years from the date of such upward change. This is effective from October 2022.

More needs to be done

Recently, action has been taken to address the issue of delayed payment for supplies by MSMEs and also encourage PSUs to procure goods/services from MSMEs through public procurement policy and the augmented grievance redressal mechanism. Another change is in the criterion for grading export units and according them status holder certificates.

Incentives were being extended to MSMEs in the recent past, post pandemic. Unfortunately, under the MSME Act only producers are eligible to avail these, while merchant trade exports are left out from the definition. This issue needs to be addressed and ensured that merchant trade exports are also eligible for the same benefits.

Small exporters sometimes face difficulties in realising their export proceeds on account of disputes of quality, and or unwillingness to pay by rogue buyers after getting the goods imported from India. This creates great loss to them and they cannot travel abroad to get the money nor pursue legal option as it is expensive. Although commercial officers in the Embassies help in this regard, more needs to be done. Likewise in the local banks’ level, a nodal officer to extend all help in establishing L/C, handling and realising export bills, import clearances is required. Also, a helpful customs department and de-bottle necking at ports, will go a long way in attracting more small businesses into export arena.

Exports make a country’s economy healthy and this is what the new FTP hopes to achieve.