HDFC, the largest Housing Finance institution, (started as a specialised mortgage company in 1977), fostered and nurtured and now handed over to HDFC Bank, was Deepak Parekh’s lifetime achievement.

HDFC extended home loans to 90 lakh families accounting over Rs 6 lakh crore. HDFC Bank, was promoted as a subsidiary and commenced operations in January 1995. It held 19 per cent stake in the bank. “As the son grows older, he acquires the father’s business,” said Parekh on the reverse merger. The mega banking merger exercise started 15 months ago, is finally completed. This merger is a master-stroke of sorts. There have been several bank mergers, most of them turned successful, considering now in retrospect.

Why the merger?

NBFCs enjoyed a regulatory arbitrage in, ‘what banks could not do, the NBFCs were able to do.’ Now NBFCs, being shadow banks, have also been brought into increased RBI scrutiny and regulation. With increasing interest rates, HDFC had to bear high cost of funds, to be able to lend more home loans. Unlike banks it cannot raise unlimited amounts of deposits. HDFC had a concentrated exposure to real estate, i.e., mostly home loans; is considered safer as a bank with a diversified portfolio of loans. Without depending on volatile wholesale funding, it can access DICGC insured retail deposits and also avail RBI’s emergency funds facility. This makes the merger a compelling proposition for HDFC. For the bank, immediate expansion of safer risk weighted assets and exposure to large number of home loan borrowers, turning captive depositor-clientele, offers scope for increasing resources and revenues. Thus, the merger would bring in lot of benefits and is a definite win-win.

A whole large range of financial products

The bank will become the second most valuable Indian company and assume the highest weightage in the NSE benchmark stock index, Nifty 50. It becomes the fourth biggest bank, surpassing global behemoths HSBC, Bank of America and JPM Chase. The bank has thus transformed into a financial services conglomerate, offering a full suite of financial services. Hitherto, it was only distributing these products for a fee.

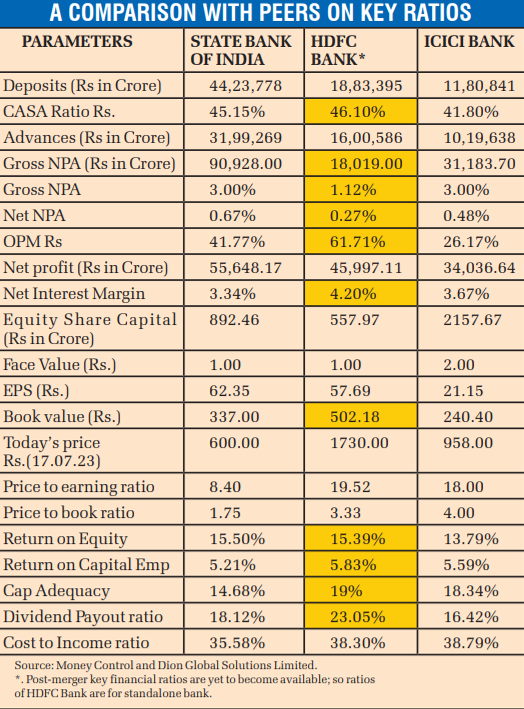

HDFC Bank is the second largest after SBI, in terms of its advances. Market share shall increase tremendously to nearly 16.5 per cent. Its loan book at Rs 22.2 lakh crore is more than double of ICICI Bank’s (Rs 10.8 lakh crore), as of March 2023, next only to SBI’s Rs 32 lakh crore. The advance-mix undergoes significant change, by reducing corporate and rural banking from 38 to 27 per cent, personal loans from 10 to 7 per cent and increased home loans from 6 to 27 per cent due to merger. Bank’s retail book will become bigger with larger mortgage loans. The already big bank has become even bigger.

The bloated mortgage book, at over 27 per cent in the bank’s advances portfolio, with an average tenure of 20 years can have its pros and cons. The long relationship with the home loan borrowers gives it an edge to cross-sell other loan products like personal loans, auto loans and credit cards. On the deposits side, around 35 lakh HDFC’s borrowers are available to the bank to tap for savings or term deposit accounts with the bank. There is thus scope to expand its customer base and improve relationship. The CEO says that the new product suite means “moving from sales management to relationship management.”

HDFC brought with it, subsidiaries like HDFC Life, HDFC AMC and HDFC Ergo expanding the scope for the bank. The suite of financial products can catapult it to the top league and enable it to compete stronger. We have to wait and see if it would disrupt the existing banking landscape.

Complexities to untangle

Apart from a concentrated mortgage loan book, the bank has also inherited problems and slow-growing verticals and a ‘high cost-of-fund institution’. These will haunt in the short term, till a viable and sustainable solution is arrived at. The large share of mortgages will compress the margins. HDFC Bank’s Net Interest Margin (NIM) is expected to dip to 3.8 per cent levels, (from 4.1%) given the lower yields on home loans. To grow bigger, faster, getting low-cost funds is critical. But it faces intense competition from banks who target the youth, for current and savings accounts and expanding loan book.

There have been several doubts in the minds of existing home loan borrowers of HDFC as to what changes the merger would bring – especially the interest rates, EMI servicing as well as any new conditionalities. Integrating both the institutions’ systems and processes might throw up some glitches in the initial phase but both being technologically experienced, would tide over the issues. Finding the synergy with the human resources and the systems and processes between the institutions will be the first task the CEO needs to handle.

HDFC Bank’s management is confident of its ability to grow its deposits by tapping into HDFC’s existing customer base and expanding its branch network. In view of stagnant retail deposits-due to inflation and deposit interest rates not adequately mitigating it – and every bank clamouring for the same pie, in the next three to four years, it is going to be stiff competition among banks to garner deposits. This will compel them to offer competitively higher rates on deposits, needed for servicing the expanding loan book.

The post-merger effect

Higher net-worth will enable the bank to enhance flow of credit and offer scope for larger ticket infrastructure loans. HDFC bank currently commands a better NIM compared with HDFC Ltd. Analysts predict pressure on the NIM. The gross NPA/Net NPA ratios, post-merger, will slightly worsen. However, there is elbow room to improve provision coverage ratio in the medium term. But the risk in balance sheet is expected to decline as risk weighted assets for housing finance is lower than other loans in the bank. Hence, RWA may decline 7 to 8 per cent. Further, the cost to income ratio will benefit the most by falling to 35.2 per cent versus more than 40 per cent in FY23 for HDFC Bank. The bank intends to reduce this further to less than 30 per cent. The ROA is also expected to remain strong at over 2 per cent for the merged entity.

Stock performance expectations

As per the share exchange ratio, HDFC Bank has allotted 311 crore shares to eligible shareholders i.e. 42 new equity shares of the face value of Re. 1/- each, for every 25 equity shares of the face value of Rs. 2/- each held by such shareholders in HDFC Ltd. Now the equity capital of the bank has increased to Rs 753.75 crore.

Though the PE ratio looks higher, the stock has not outperformed in the last two to three years. However, both EPS and PE are projected to rise after the merger. Once a hot favourite of FIIs, the underperformance last year was mainly due to exit of FIIs from the Indian bourses when US interest rates started climbing up. When FIIs return, the fortune of the bank would turn definitely better. Several brokerages have said that HDFC Bank is a compounder available at attractive valuations and is expected to cross Rs 2200 to Rs 2500 in the next 12 months. There is ample scope for this, considering the positives of this merger.