It appears that the latest is the culmination of the enquiries that have lasted many months and the bank had been warned of regulatory action even earlier.

Consequent to this, the listed entity has seen a major erosion in its market cap, with the share price being almost half of its 52-week high. And questions raised about the role of the board and especially that of the independent directors in possible oversight lapses.

To set the facts out as the media reports lack due clarity, the regulatory action is on Paytm Payments Bank Ltd which has a banking licence. The said entity has an independent board though it is unlisted. The listed entity, OCL holds 49 per cent of the equity of the bank. The rest of the ownership is not known. The bank has its own website but has not uploaded its annual report in the same. Being unlisted it may take shelter that such public disclosure is not necessary. The website of OCL does not have the annual report of the bank as the same is not a subsidiary!

Contrasting position of One Communications

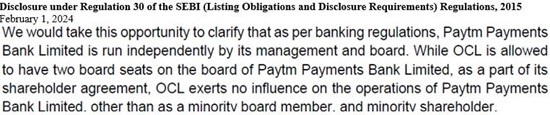

OCL in its annual report has included the bank among the list of entities over which it has significant influence. However, its public intimation to the stock exchanges on 01 February has a very contrasting position on this. The necessary extract from its press release is given for understanding the discrepancy.

The stance that the bank is not under its influence and the operations are completely autonomous not only contradicts the disclosure in the annual report for the period 2022-23 but also raises the question about who controls the bank beneficially!

Vijay Shekhar Sharma is acknowledged as the promoter and creator of the Paytm cluster and is the face of this enterprise in totality. There are multiple entities and some are subsidiaries and some are associates. The public listed entity OCL is in some sense seen by the investors as aggregating the value of the entire cluster subject to the interest of other shareholders in those entities.

The bank is integral to the success of the overall business model and the stance of treating it as an associate may be technically right but the inconsistency in the picture as above needs more clarity.

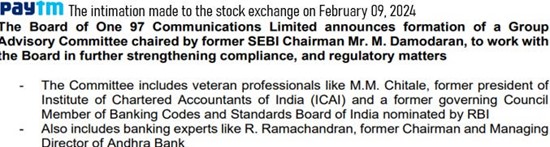

Another contradiction is the announcement of a committee to sort out the regulatory issues by OCL on 9th February. 2024. This committee is constituted by OCL, when the bank is the subject of the regulatory lapses. As mentioned, the bank is said to be completely independent and not subject to the control of OCL.

Which board will over see the functioning of the committee?

The independent directors of OCL are persons of professional standing and why they felt unequal to the task of taking a more active role in setting right the governance and systemic lapses in the bank is equally a question that crops up.

How much did they review the functioning of the bank in the board proceedings of OCL given the umblical cord is worthy of asking. They are also well rewarded, including professional assignments being handed out to firms with an independent director being a partner!

OCL has acknowledged in its press release that the impairment of the operations of the bank would have a bottom-line implication (up to Rs 500 crore annually). That puts the board of OCL in a key role in ensuring the proper functioning of the bank.

Similarly, the auditors of OCL have nowhere commented about the potential implications of regulatory actions against the bank impacting the operations of the company. It is not clear if even the auditors of the bank noted these developments which date back to March 2022.

It is also not in public domain if the bank and OCL have the same auditors. OCL had a change of auditor ahead of the regulatory period of ten years in 2023. The previous firm of Price Waterhouse Chartered Accountants LLP gave way to S R Batliboi & Associates LLP only after completing the quota of first five years out of the two such consecutively allowed.

Since such changes do not come within the purview of resignation, these go unnoticed and not commented.

Are super star CEOs to blame?

Vijay Shekhar Sharma is the Chairman, M.D and CEO of OCL. He is the non-executive chairman of the bank. The bank has a CEO which may have arisen out of the compulsion of RBI that seeks a separate CEO for each bank. Despite such regulatory checks the influence of the promoter may be significant and most likely the board and the CEO of the bank act often under his instructions.

Superstar CEOs are a fact of the corporate world and recently the court in Delaware commented upon the phenomenon in the context of Elon Musk. The boards in such cases function in awe of such persons and fail to act independently.

RBI has been firm about how banks should be governed and its policy of not letting industry groups into banking has often been grudgingly admired.

Should it draw lessons from the Paytm episode and look at such suspicious arrangements as in the present case to see if banks be made completely independent of any such corporate clusters and with a dispersed shareholding so that no promoter or individual has any say?